Did you know that the average college graduate has $35,000 in student loan debt? Yikes! If you are dealing with student loans, you are definitely not alone and you are not defined by your debt! When I speak to groups, over half of the audience typically has some form of debt, whether it’s a personal debt or a student loan debt. Luckily, there’s something we can do about it! Here are five tips for paying your student loans as quickly and efficiently as possible.

Get Naked With Your Debt:

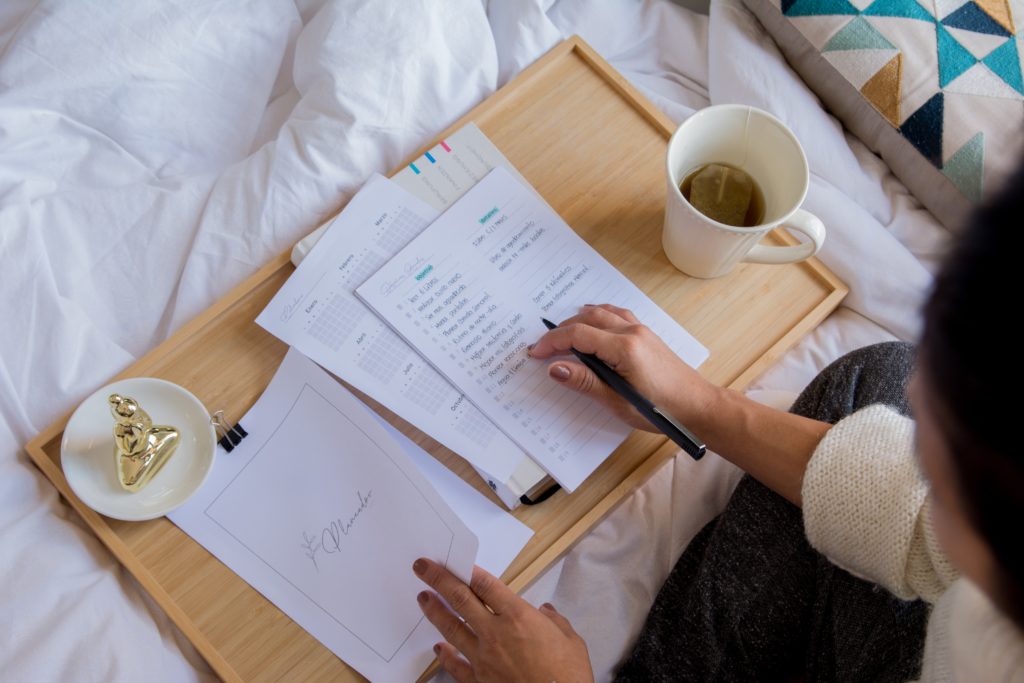

I know, it sounds a lot sexier than it feels. But first and foremost, we want to take inventory of the debt we have. This sounds pretty simple, but listing out the information for each loan can be an extremely liberating exercise. When you do this, write down the loan amount, who the loan is with, the interest rate, the monthly payment amount, and the payment date. Once we know what we have, we can put together a plan and do something about it. We’re back in power.

Decide What Comes First:

Now it’s time to prioritize. We will decide which debt to pay off first while maintaining the monthly payments on the other loans. The pay-down priority will be different for everyone. You may want to pay off the smallest loans first to build momentum, the highest interest rate debt first because it’s costing you the most money, or the debt that makes you the most upset. Write down the priority of each loan on your debt inventory.

Try and Negotiate:

This may sound too good to be true, but negotiating down the interest rate on your debt can actually work. I’ve seen it! Call up a representative and ask to be directed to someone to talk to about the interest rates on your loans. What’s the worst that can happen? They might say no, but they could also say yes and that would save you a lot of money!

Get Smart With Your Payments:

If you are excited to put more money toward your student loans than the monthly payment, beware. Your student loan website might be set up to put any extra payment toward future payments rather than toward paying down the principal.

While you have someone on the phone to negotiate interest rates, bring up your payments. Find out how much of your monthly payment is going towards interest and how much goes toward paying down the principal. If you are mostly paying interest, your loan balance won’t decrease much. If you have some extra cash available to put toward your loans, make sure to confirm where it’s going.

Celebrate and Enjoy the Ride:

Once you make your plan, you will want to decide how to celebrate along the way! How will you celebrate important milestones? Will you treat yourself at each $5,000 increment? Maybe you will have a debt-free party when you pay your loans down completely? This might sound too fun to be helpful, but it’s extremely important to celebrate how far you’ve come. Don’t skip this important step!

Ashley Feinstein Gerstley is a money coach demystifying the world of money and personal finance. Get her exclusive how-to guide “30 Days to Financial Bliss.” It’s free for Elana Lyn readers!

14 Responses to 5 Steps to Paying Your Student Loans